Hidden Orders and Volatility

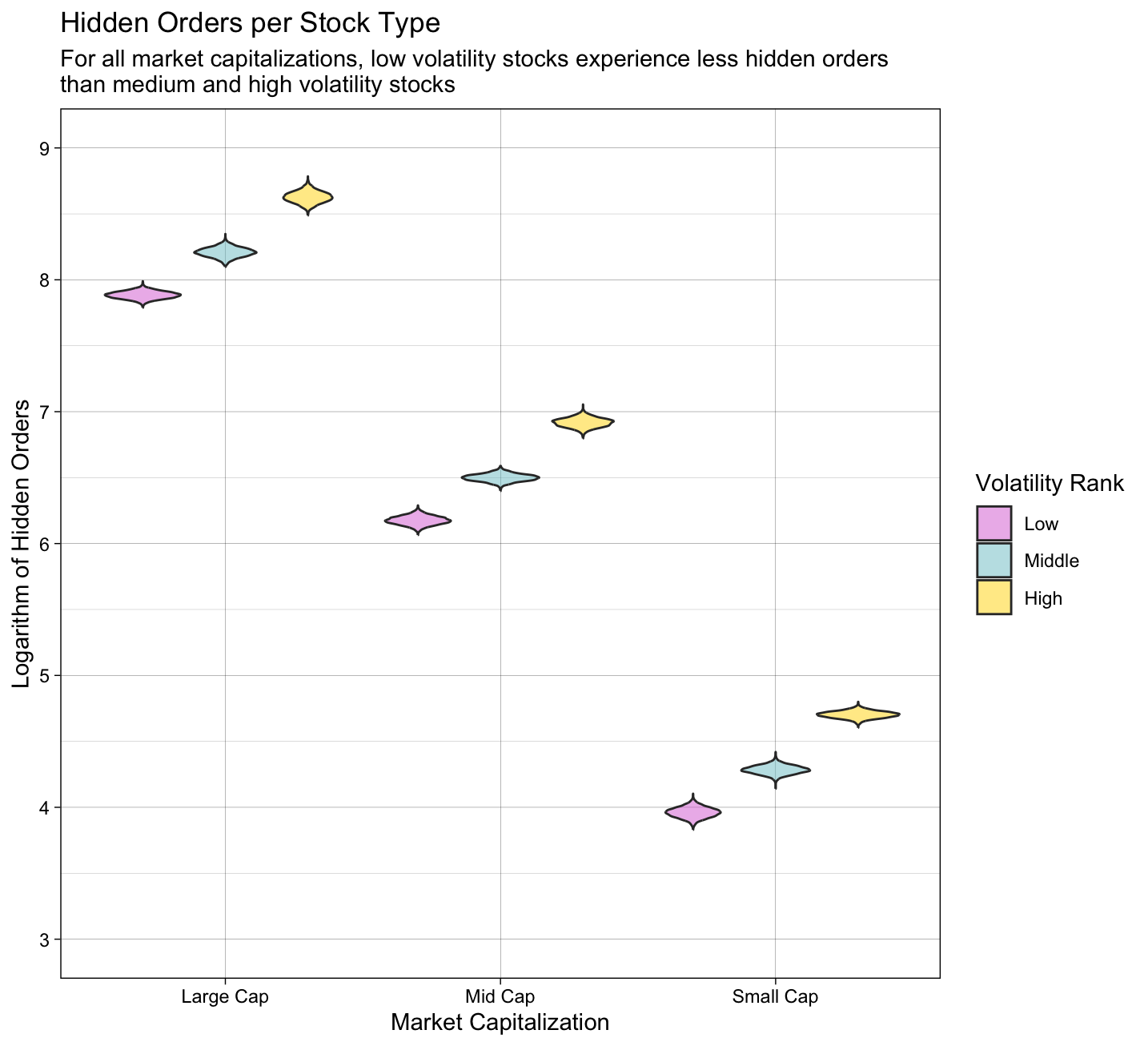

Stocks with different qualities experience different amounts of hidden orders. Using early 2024 data from the Securities and Exchange Commission (SEC), I seek to understand the relationship between a stock’s volatility level and number of hidden orders in US markets. There is some concern that the SEC’s methods of measuring volatility may slightly differ from individual investors. I modeled the logarithmic transformation of hidden orders as a Bayesian linear function of volatility level and market capitalization. A change in volatility level is associated with a percent change in hidden orders, where the variable is multiplied by the constant e. Low volatility stocks experience about 48% of the hidden orders high volatility stocks experience, although the true number could be as high as 52% and as low as 44%, and varies with market capitalization.

Terminology

Volatility: A measure of how quickly stock prices fluctuate over time. Increased volatility is often a sign of uncertainty or fear among investors. It is usually calculated using the standard deviation of a stock’s price, but traders sometimes use other formulas.

Hidden Orders: A method of ordering shares of a stock that masks the true size of an order. Traders often use hidden orders when purchasing large amounts of shares, or when making trades that have the potential to shift market activity.